First, tell me what is sold to us?

Remember, some CA, or a finance guy or nowadays any influencer (that too on reels) giving financial

independence tips and telling you the FIRE movement.

What is (FIRE)?----

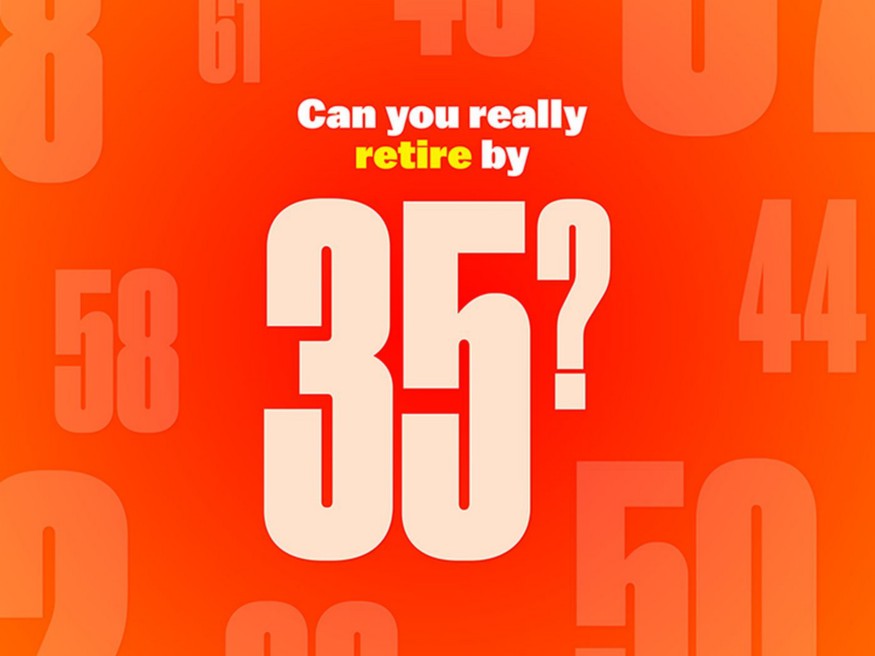

Financial Independence, Retire Early (FIRE) means saving and investing around 70% of the income now so that

you can retire early.

According to FIRE, when that money after saving and investing every year reaches around 30 times the yearly

expenses then one can quit the day job or completely retire from any form of employment altogether.

Example:

If the yearly expenses are around Rs. 5 lakh with a moderate lifestyle,

then the money required for retiring is around Rs. 1.50 crore.

Okay! So now we understand what is sold to us.