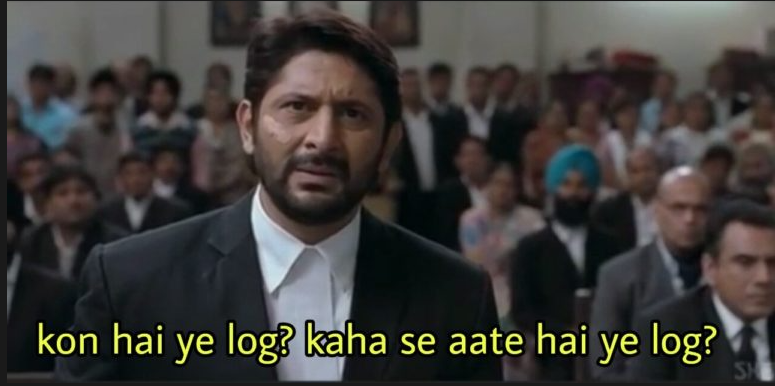

These are the new breed of RETAIL INVESTORS.

My definition of Retail Investors - emotional impatient individuals entering the markets to make it big,

thinking that reading a few articles on the internet and watching several videos on Youtube will help them

understand the market completely and time it to perfection.

I have termed those retail investors those who have started their investing journey during the pandemic as

Pandemic Investors.

Just to give some stats about the recent influx of Pandemic Investors into the market — The country’s

leading exchange, the BSE, crossed the milestone of 7 crore registered users on June 7, 2021. “The growth

has been fuelled by Retail Investors, with an age profile of 20–40, who contributed 82 lakh out of the 1

crore user additions from 6 crores to 7 crores,” BSE said.

So inspite of having the most deadly virus destroying lives outside. The markets have doubled since the

start of the COVID pandemic. And these Pandemic Investors have contributed by bringing more money into the

markets.

Why most of the Millennials and the Gen-Z entered the markets?

- FOMO- (Fear of Missing Out)

This is the same feeling we have when we check stories on Instagram.

(For those who don’t know or haven’t acknowledged it yet- Fear of Missing Out refers to the feeling or

perception that others are having more fun, living better lives, or experiencing better things than you

are.)

FOMO is the most powerful tool used for selling ideas, dreams and products over the internet today.

FOMO from wealth creation, financial independence, a secondary source of income, risk-taking attitude,

stock markets, etc. was posted extensively on Instagram and Twitter during the pandemic. And since there

was no other work to do than to sit with Instagram all day this was bombarded multiple times which

eventually made the Pandemic Investors to make their first investments.

Pandemic Investors to Fixed Deposit (FD) friend: “ I made 5k in 5 days with 12k investment, you will

require at least 8 years to do the same.”

Now, FD friend having FOMO from markets asks, “ How to open a Demat account? ”

(DEMAT Account: the account mandatory for investing/trading in the markets)

-

Creator economy:

Many influencers who used to tell where to eat, what degree to pursue, which country to visit, which

footwear looks good over formals started content around personal finance.

These always hungry for content creators have fuelled the Pandemic Investors to start investing.

Venturing Pandemic Investors into retiring at 35 and TINA-There Is No Alternative other than Stock

Markets and Cryptos to get rich and achieve financial freedom.

-

Tweets/Reels/Memes/Chat Groups:

Smart Pandemic Investors do not research, they watch Instagram reels and take financial decisions.

People started recommending stocks in less than 30 seconds over reels without explaining the whys and

hows…

Everybody wants to be rich as soon as possible but in 30 seconds.

-

Last but not the least- Elon Musk

I don’t need to tell you what he did in the crypto-space…

For every movement in history there are some positivies and some negatives.

-

Positives:

People understood that investing early on in life is as important as going to school or college

Taking care of their personal finances is also possible if they pay attention at regular intervals.

-

Negatives:

(There is a term known as bull — run in the stock markets. It denotes the period in the stock market

when there is excessive optimism about the markets and the stock prices keep increasing substantially.)

During this pandemic we have seen a bull-run. Anybody investing money in the past 1 year has only seen

profits in the markets

Now this has made most of the Pandemic Investors think that they are in the Warren Buffet League. All

the stocks in they possess have either doubled or tripled in some case; giving them a sense of

confidence that they have understood what the markets are.

After being into so many groups on social media, interacting with a lot of investors over different

forums, I have seen the overconfidence in the psuedo-knowledge these Pandemic Investors possess. They

just watch 1–2 videos, read 10–20 mins about the stock on the internet and are ready to make their

opinions.

A short story:

Some crypto manic advised me to stop investing in stock markets and mutual funds because it gives me

puny returns and turn to crypto instead.

I asked him, “Do you really think crypto currency is decentralised?”

He fought for 20 mins telling me the importance of blockchain technology and the future of

crypto-currencies but failed to answer my question with some degree of logic.

(Note: A classic fall back reason for all the crypto manics to justify their investments)

When Bitcoin fell badly I found this same guy telling other people to diversify into different

assets.

How to move forward?

-

Listen, read and think as much as possible.

-

Make notes of the names of the stocks and mutual funds which float over social media.

-

Analyze them, see what things are common.

-

Make an informed decision before buying any asset.

-

You don't have to possess all the stocks. Avoid impulsive buying. It’s never to late to invest.

You may lose out on some important events but think in terms of long term.

-

Do not show your risk taking attitude in penny stocks and shit-coins. There is a subtle

difference between high risk — high reward and gamble.

-

Don’t over-invest because of the bull-run.

-

Do not use the promo-code INFLUENCER50 and enter the crypto space, understand the underlying

projects on which the currency operates. If the market corrects (subtle word for ‘falls’) just

like it has been doing in the crypto space, please do not leave the market. Learn and come back

strong. Also to come back strong you need some money. So point no. 7 helps.

-

It is a great thing to have financial literacy. You are not supposed to know everything but

pseudo-knowledge is dangerous.

-

India still is a developing nation. Money is going to flow. Markets are going to grow. Be

patient. Be opportunistic.

Don’t benchmark profits earned in the pandemic. Everybody makes money in the bull run.